In the evolving landscape of international taxation, traditional tax havens such as Ireland, Bermuda, and Singapore are undergoing significant transformations in response to the OECD’s Base Erosion and Profit Shifting (BEPS) initiative and the introduction of the global minimum tax (GMT). These reforms aim to curb profit shifting and ensure a minimum effective tax rate of 15% for multinational enterprises (MNEs), prompting these jurisdictions to reassess and adapt their fiscal strategies in a rapidly changing global environment.

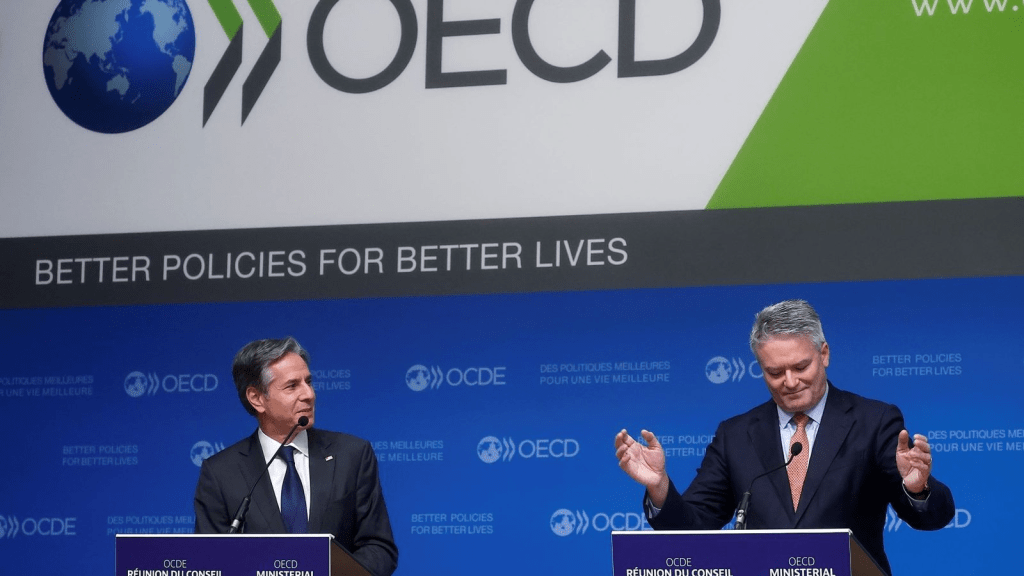

Source: Council of Foreign Relations

Understanding BEPS and the OECD’s Two-Pillar Framework

The BEPS initiative, led by the OECD and G20, addresses loopholes and mismatches in international tax rules that have historically allowed multinational corporations to shift profits to low or no-tax jurisdictions. To combat this, over 140 countries joined the Inclusive Framework on BEPS and committed to a two-pillar solution.

- Pillar One reallocates a portion of taxing rights to market jurisdictions, regardless of a company’s physical presence.

- Pillar Two introduces a global minimum corporate tax rate of 15% for MNEs with consolidated revenues exceeding €750 million.

The implementation of Pillar Two is particularly transformative for low-tax jurisdictions, compelling them to introduce effective minimum taxation or risk losing taxing rights to higher-tax jurisdictions via “top-up” taxes.

Ireland: Balancing Tax Competitiveness and Compliance

Ireland has long benefited from a 12.5% corporate tax rate, drawing MNEs such as Apple, Google, and Pfizer. While the GMT represents a shift from this model, Ireland has chosen to adopt the reforms while safeguarding its appeal through broader economic stability and infrastructure advantages. The Finance (No.2) Act 2023 marked a significant step in Ireland’s compliance, introducing withholding tax measures on outbound payments to associated entities in specified territories starting April 2024.

Interestingly, Ireland projects a budget surplus of €24 billion in 2024, largely driven by exceptional corporate tax receipts. This fiscal buffer positions the country to invest in domestic priorities like housing and healthcare, thereby reinforcing the social infrastructure that underpins long-term economic competitiveness. Moreover, Ireland continues to emphasize non-tax advantages such as skilled labor, EU membership, and regulatory certainty to maintain its attractiveness post-GMT.

Bermuda: Shifting from Zero to Strategic Taxation

Traditionally a zero corporate tax jurisdiction, Bermuda has found itself at the crossroads of international scrutiny and reform. The government is now consulting on implementing a corporate income tax between 9% and 15% for MNEs meeting the €750 million threshold. This initiative is a strategic pivot to comply with GMT requirements while retaining its role as a global reinsurance and financial services hub.

The OECD’s Forum on Harmful Tax Practices (FHTP) has actively monitored no- and nominal-tax jurisdictions like Bermuda. Through its substantial activities requirements, the FHTP ensures that entities claiming tax residency in these jurisdictions have genuine economic substance. Bermuda has responded with regulatory enhancements, including economic substance laws and improved transparency mechanisms. These steps are essential not only for compliance but also to maintain investor confidence in a post-GMT global order.

Singapore: Recalibrating Incentives in a High-Scrutiny Era

Singapore has taken a pragmatic approach to GMT, leveraging its sophisticated infrastructure, legal framework, and reputation for transparency. While its effective corporate tax rate is already above the GMT threshold, many of its sector-specific incentive schemes are being recalibrated.

The 2025 national budget introduces key reforms, including a corporate tax rebate for new listings and enhancements to existing tax exemption schemes under the Global Trader Programme and Financial Sector Incentive. These incentives are being redesigned to comply with OECD guidelines, especially regarding transparency and non-discrimination.

Singapore is also preparing to implement Pillar Two rules by 2025, with public consultations underway. The country is emphasizing a “whole-of-government” approach, coordinating across ministries and regulatory bodies to balance compliance with continued economic competitiveness.

Policy Convergence and Corporate Strategy Shifts

Globally, over 40% of preferential tax regimes reviewed under BEPS have been abolished or amended. This signals a trend toward convergence in tax policy, particularly in how jurisdictions compete for FDI. As the tax playing field levels, non-tax factors—like innovation ecosystems, regulatory clarity, and quality of life—are becoming increasingly pivotal in corporate decision-making.

Corporations are also reassessing their tax planning strategies. With the global minimum tax reducing the gains from profit shifting, firms are now focusing on aligning profits with real economic activities. This trend, known as “onshoring,” is already evident in sectors like pharmaceuticals and technology, where companies are building out substantive operations in key markets to avoid tax penalties.

The Quiet Evolution of the OECD Rulebook

While the spotlight has been on GMT implementation, ongoing discussions within the OECD include additional reforms that are less publicized but equally transformative. These include enhanced Country-by-Country Reporting (CbCR), digital services tax alignment, and the possible establishment of a multilateral dispute resolution mechanism.

A recent OECD report also floated the idea of a “Pillar Two Plus” approach—whereby tax incentives would only be allowed if they are tied to real economic activity, such as R&D or green investments. While not yet formalized, this could significantly reshape the architecture of international investment incentives.

Conclusion

The global minimum tax is not merely a technical tweak to corporate tax policy—it is a paradigm shift. For jurisdictions like Ireland, Bermuda, and Singapore, the challenge lies in evolving without losing their unique economic identities. For the OECD and its member states, the focus must remain on effective implementation, minimizing loopholes, and ensuring that the new system supports both equity and efficiency.

As 2025 approaches and more jurisdictions roll out domestic legislation aligned with Pillar Two, the true test will be in how multinationals respond—not just in tax compliance, but in where and how they choose to grow. In this new era, the battle for corporate presence will no longer be fought solely through tax rates, but through transparency, stability, and value creation.

Leave a comment