How Tariffs Affect US and Global Automotive Brands

The global assembly line of the automobile industry, where each nation contributes a crucial piece, has encountered a significant obstacle: tariffs imposed by the United States. This financial hurdle, with new tariffs on imported vehicles and auto parts taking effect as of April 3rd, 2025, has sent ripples throughout the sector, disproportionately affecting certain players while others navigate the situation with less disruption. The exact tariff rates are complex and depend on various factors, including the country of origin and specific trade agreements.

The Tariff Terrain: Identifying the Most Affected

Companies with substantial reliance on importing vehicles or components into the US have experienced the most significant repercussions. European automakers like BMW and Mercedes-Benz, known for their luxury exports to the American market, face a newly imposed tariff, the specific rate of which will impact their pricing competitiveness. Similarly, auto parts manufacturers in countries like Mexico and Canada, whose supply chains are deeply interwoven with US assembly plants operated by companies like General Motors and Ford, face tariffs on their exports. While the USMCA agreement offers some exemptions based on regional value content, the non-US content remains subject to duties. Stellantis, the parent company of Jeep and Chrysler, which imports a significant portion of its vehicles from Europe and Mexico, anticipates a substantial increase in the cost of their vehicles sold in the US, with the exact impact depending on the specific tariff rates applied to these regions.

Conversely, domestic US automakers with considerable local production capabilities might seem less directly impacted by import tariffs on complete vehicles. Tesla, for example, manufactures its vehicles primarily in the US, potentially shielding it from direct import duties on finished products. However, even these companies are not entirely immune. The 25% tariffs on imported steel and aluminum, implemented earlier, elevate their raw material expenses. Furthermore, companies like General Motors and Ford source a significant percentage of their components from Mexico and Canada. While the USMCA aims for tariff-free trade for qualifying goods, the rules of origin, requiring a high percentage of North American content, mean that tariffs could still apply to portions of these components, especially if they incorporate materials or labor from outside the region.

The Apple Comparison: A Different Gear for Automotives

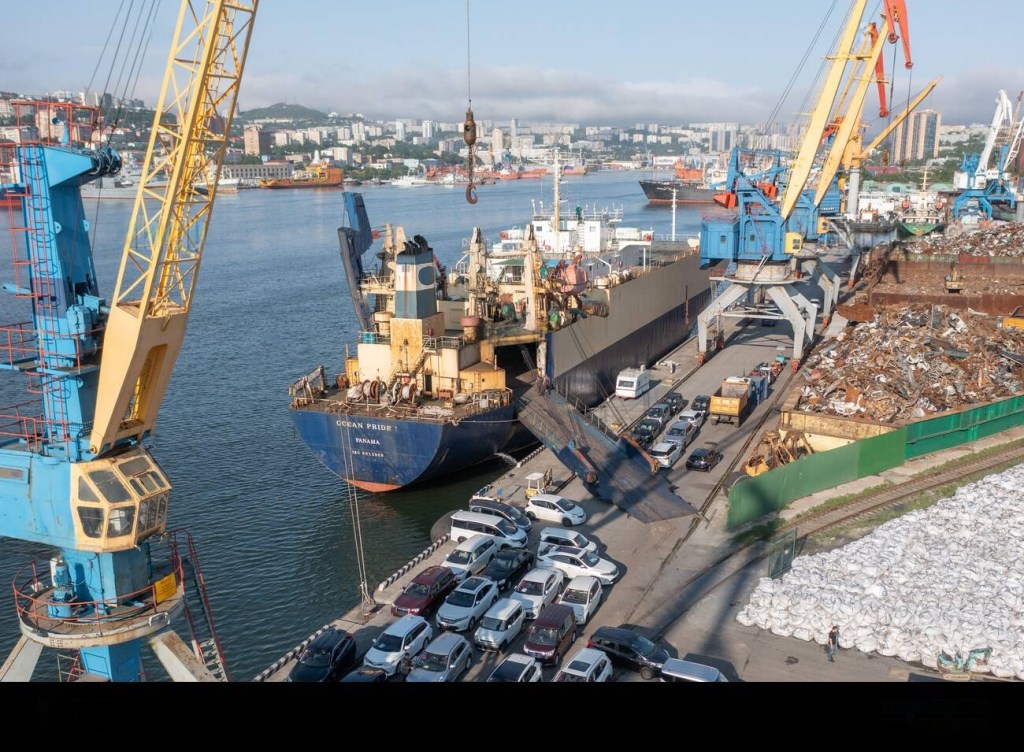

The reported instance of Apple Inc. importing a large quantity of goods from India in advance of potential tariff changes highlights a strategy to mitigate future costs. However, applying this approach to the automobile industry presents considerable challenges. Cars and large automotive components are bulky and necessitate extensive logistical planning and infrastructure for storage. Unlike electronics, which can be stockpiled with relative ease, maintaining vast inventories of vehicles or large parts well in advance is often impractical and financially draining for automakers due to warehousing expenses and the risk of product obsolescence.

Furthermore, the prevalent “just-in-time” inventory management systems employed by major automakers like Toyota and Honda depend on a seamless and predictable flow of parts, rendering large-scale pre-importation disruptive to established supply chains. While some automakers might have slightly adjusted their shipping schedules in the weeks leading up to the April 3rd tariff implementation, a large-scale pre-importation akin to Apple’s reported actions is not a feasible strategy for the automotive sector.

Navigating the Headwinds: Industry Responses to Tariffs

Faced with escalating costs due to tariffs, the automobile industry has been actively exploring various strategies to adapt. Some companies, like Hyundai and Nissan, are reportedly evaluating their pricing strategies and may absorb some initial costs to remain competitive. Others, particularly luxury brands like BMW and Mercedes-Benz, are expected to pass on at least a portion of the new import duties to consumers.

Another notable response has been the reassessment of supply chain strategies. Automakers are investigating the diversification of their sourcing, seeking alternative suppliers in countries not subject to the same tariffs. There have also been instances of companies considering or actually relocating some production or assembly operations to the US to circumvent import duties altogether, although this is a complex and time-intensive undertaking. For example, there are reports that Toyota is re-evaluating its North American production footprint to optimize for the new tariff regime. Similarly, Volkswagen, which imports a significant number of vehicles from Europe and Mexico, is under pressure to increase its US-based production or face higher costs.

Furthermore, manufacturers are closely examining the rules of origin under the USMCA. Companies like Ford and General Motors are likely to increase their focus on sourcing more components from within North America to qualify for tariff exemptions, although meeting the stringent regional value content requirements presents its own set of challenges.

Conclusion: An Industry Adapting to Change

The imposition of tariffs has undeniably generated significant disruption within the global automobile industry. While companies with significant import reliance, particularly those importing from regions facing higher tariff rates, have experienced a more pronounced impact, the interconnected nature of the sector ensures that the effects are felt across the board. The industry’s response, characterized by pricing adjustments, supply chain diversification, and a strategic re-evaluation of production and sourcing, illustrates a sector actively striving to navigate this evolving economic landscape.

Given the intricate nature and global reach of the automotive industry, and the varying tariff rates applied to different countries and components, how will these nuanced tariff policies ultimately reshape global automotive trade and production in the long term?

Leave a comment