From Deflation to Inflation: Japan’s Economic Transformation

Remember when “deflation” was the word on everyone’s lips in Japan? Years of stagnant prices, a consumer mindset stuck in savings mode, and a persistent economic malaise painted a picture of a nation struggling to ignite its economic engine. Well, those days have faded away, replaced by a new, equally challenging reality: inflation. The shift has been swift, and the impact is hitting Japanese households and businesses hard. But how did we get here, and what can be done to navigate this turbulent economic shift?

The Long Shadow of Deflation: A Culture of Caution

For decades, Japan grappled with deflation, a phenomenon where prices steadily decline. This created a peculiar economic environment. Consumers, expecting prices to fall further, delayed purchases, further dampening demand. Companies, facing shrinking profit margins, hesitated to invest or raise wages. This cycle of caution became deeply ingrained, creating a psychological barrier to economic growth.

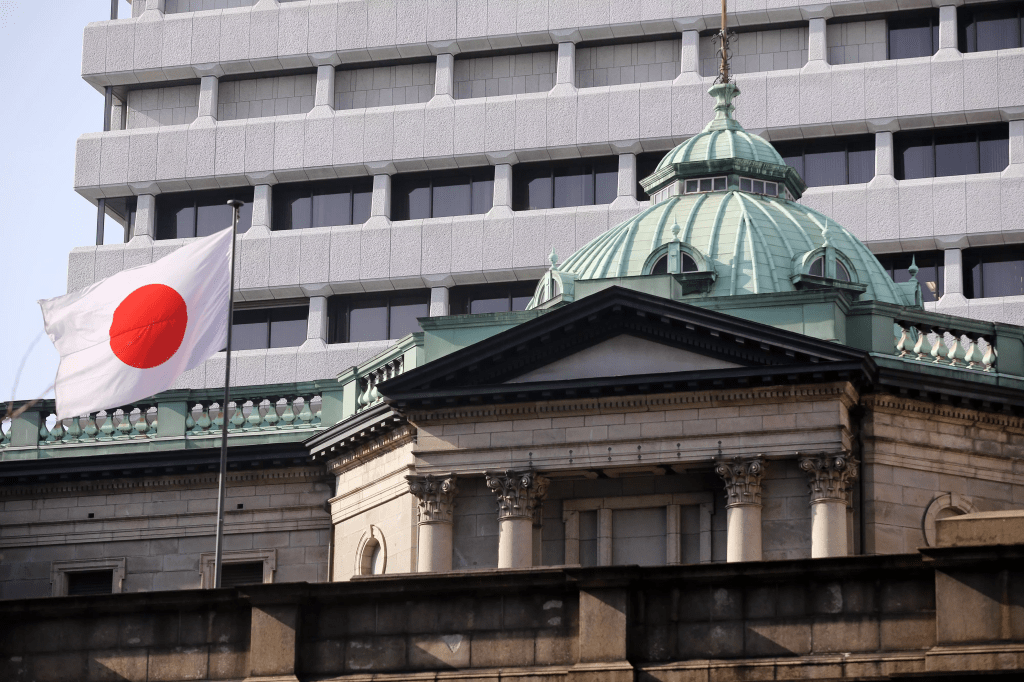

The Bank of Japan (BOJ) attempted various measures, including quantitative easing and negative interest rates, to stimulate inflation. However, these efforts yielded limited results, and the deflationary mindset persisted. The lack of wage growth, despite low unemployment, meant that consumers had little incentive to spend, further perpetuating the deflationary spiral.

The Tides Turn: Inflation Takes Hold

The global economic shocks of recent years, particularly the surge in energy and commodity prices, have dramatically altered Japan’s economic landscape. The war in Ukraine, supply chain disruptions, and a weakening yen have combined to push up import costs, leading to a rapid rise in consumer prices. This sudden shift caught many off guard, as the years of deflation had conditioned both consumers and businesses to expect stable or falling prices.

Companies, facing rising input costs, are now passing these costs onto consumers, leading to a broader inflationary trend. However, wage growth has lagged behind, leaving households struggling to cope with the rising cost of living. This disparity between inflation and wage growth is a key concern, as it erodes purchasing power and threatens to dampen consumer spending.

Navigating the New Reality: Policy Challenges and Potential Solutions

The BOJ is facing a delicate balancing act. While the need to control inflation is evident, raising interest rates too aggressively could stifle economic growth and potentially trigger a recession. The challenge lies in finding a policy mix that can curb inflation without derailing the fragile recovery.

One potential solution is to focus on structural reforms that boost productivity and wage growth. This could involve deregulation, promoting innovation, and investing in human capital. Additionally, policies aimed at supporting small and medium-sized enterprises (SMEs), which are particularly vulnerable to inflation, could help mitigate the economic impact.

Furthermore, strategic fiscal policies, like targeted subsidies or tax adjustments, could provide temporary relief to households struggling with rising costs. However, these measures must be carefully designed to avoid exacerbating inflationary pressures. The government will have to balance short term relief with long term stability.

The Consumer’s Dilemma: Adjusting to a New Normal

For Japanese consumers, the era of stable prices is over. Adapting to this new reality requires a shift in mindset and spending habits. Budgeting, seeking out value, and prioritizing essential purchases are becoming increasingly important. Companies, too, need to adapt, focusing on efficiency, cost control, and innovative strategies to navigate the inflationary environment.

The shift from deflation to inflation has presented Japan with a complex set of economic challenges. How the BOJ and the government respond will determine the country’s economic trajectory in the years to come. Will Japan be able to break free from the deflationary mindset and embrace a sustainable path to growth, or will the current inflationary pressures lead to further economic instability? And more importantly, with the average Japanese citizen now facing increased cost of living, how will they adapt to this new economic reality?

Leave a comment