Understanding the Threat of a Trumpcession in 2025

As we navigate through 2025, concerns over an impending U.S. recession—what some are calling a “Trumpcession”—are growing. This term reflects fears that President Donald Trump’s economic policies, characterized by aggressive tariffs, unpredictable fiscal strategies, and policy volatility, may tip the world’s largest economy into a downturn.

While some analysts remain optimistic, recent economic indicators tell a different story. Consumer confidence is plummeting, businesses are hesitating on investments, and stock market instability is raising alarms. Could this be the beginning of a full-scale economic recession?

The Consumer Crunch: Americans Are Feeling the Pinch

The foundation of the U.S. economy—consumer spending—is beginning to show signs of distress. New tariffs on imports from Canada, Mexico, and China are increasing prices on everyday items, raising the cost of living for millions. Yale’s Budget Lab estimates that these tariffs could cost households as much as $2,000 each year.

Alongside rising expenses, American consumers are facing escalating debt. Credit card delinquencies have reached a 13-year high, with interest rates further straining household finances. January saw the first decline in real consumption in nearly two years, indicating a shift toward more cautious spending. As inflation expectations rise and disposable incomes decrease, growth driven by consumer spending may come to a halt.

Business Uncertainty: Investment and Hiring Take a Hit

The corporate world is experiencing the effects of economic uncertainty. Companies are struggling with unpredictable trade policies, complicating their future planning. The Goldman Sachs Analyst Index reveals that sales, new orders, exports, and employment all contracted in February—an alarming indicator for the economy.

Manufacturing, which was initially supported by the Inflation Reduction Act and the CHIPS Act, is now experiencing a decline in construction spending as companies become more cautious about long-term investments. At the same time, small business hiring intentions are decreasing, with the National Federation of Independent Business (NFIB) noting a significant drop in job openings. The Challenger Job Cut Report highlighted a shocking 245% rise in planned layoffs just in February.

The uncertainty around trade policies and tariffs is complicating future planning for businesses. Many firms that depend on international trade are anxious about the potential for retaliatory tariffs, which could further disrupt their supply chains and profitability.

Stock Market Volatility: A Brewing Financial Storm?

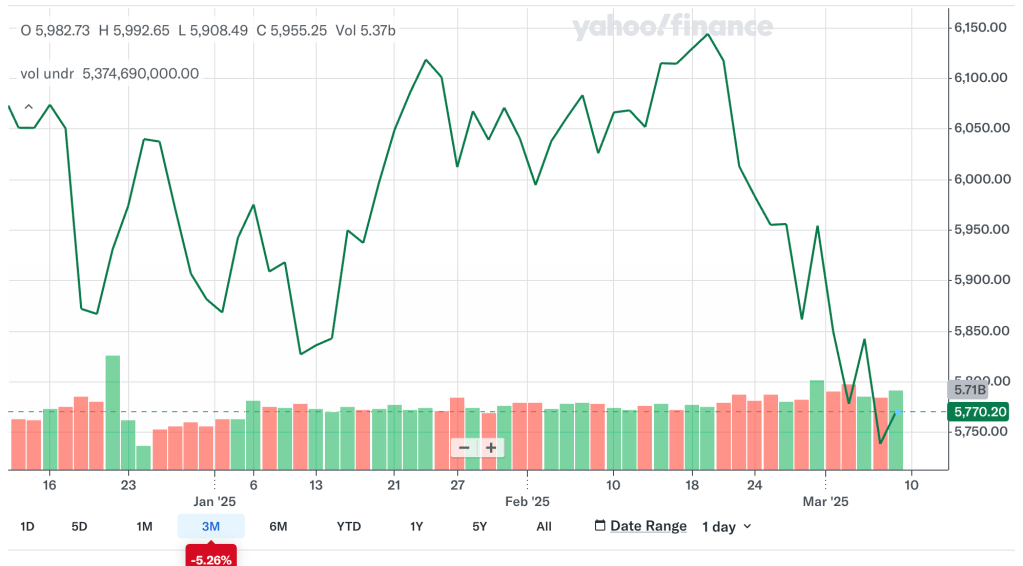

Since the beginning of 2025, the U.S. stock market has been quite volatile. The S&P 500, which had been at historically high valuation multiples, has seen sharp corrections that have erased gains made after the election. Investors are becoming increasingly concerned about Trump’s economic policies, especially in relation to tariffs and fiscal discipline.

With over half of U.S. households invested in equities, the market’s ups and downs could lead to significant economic repercussions. If stock prices keep falling, consumer confidence and spending may suffer even more, heightening the risks of a recession. A decline in stock values would also affect retirement savings and investment portfolios, contributing to financial instability.

Financial Market Risks: Could the U.S. Lose Its Safe-Haven Status?

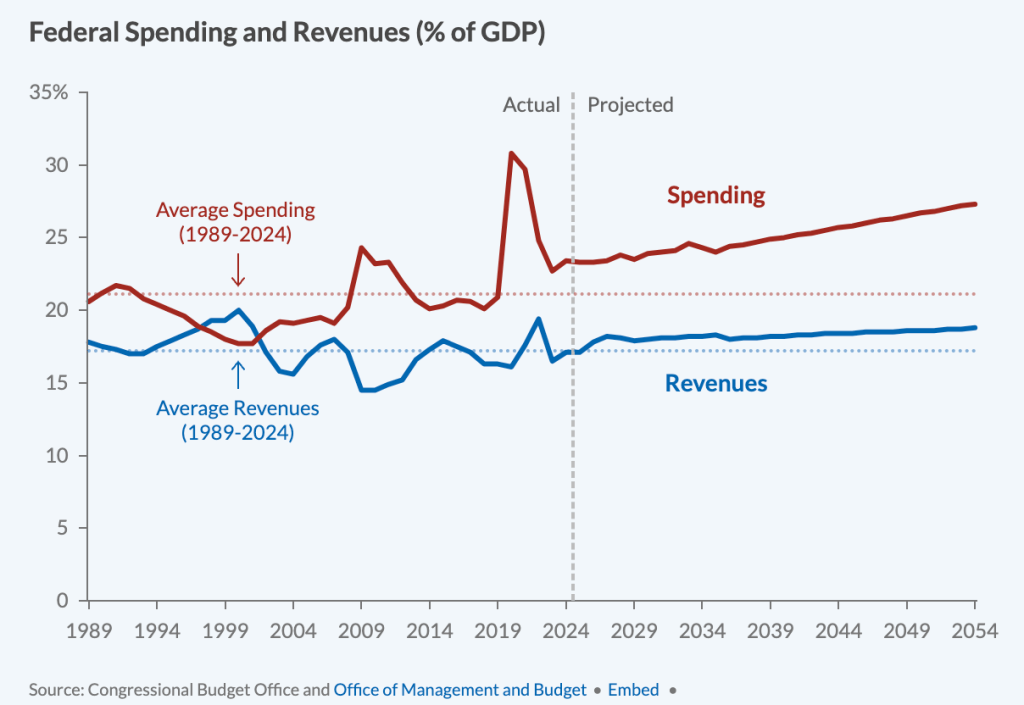

In addition to stock market volatility, broader financial risks are surfacing. Some analysts worry that Trump’s erratic fiscal policies, which include increased deficit spending and trade conflicts, could undermine global confidence in the U.S. economy. Matt King of Satori Insights cautions that the mix of fiscal irresponsibility, possible shifts in Federal Reserve policy, and unconventional economic strategies could diminish the dollar’s reputation as a safe-haven currency.

Rising Treasury yields and a potential drop in demand for U.S. debt could tighten financial conditions. If borrowing costs increase significantly, both businesses and consumers will feel the effects, which could further slow economic growth. Moreover, worries about deregulation and a possible shake-up in the financial sector might add more volatility to an already uncertain environment.

Conclusion: Is a “Trumpcession” Inevitable?

While some experts argue that a recession isn’t the most likely scenario for 2025, the warning signs are difficult to overlook. With consumer spending under strain, businesses reducing investments, stock markets experiencing instability, and financial risks on the horizon, the chance of an economic downturn seems to be increasing daily.

To avoid a full-blown recession, a major shift in policy direction is necessary—one that emphasizes economic stability rather than political unpredictability. The pressing question is: Will Trump modify his economic approach to guide the U.S. away from recession, or is a downturn now unavoidable?

Do you believe the U.S. is on the path to a recession? Share your thoughts in the comments below!

Leave a comment