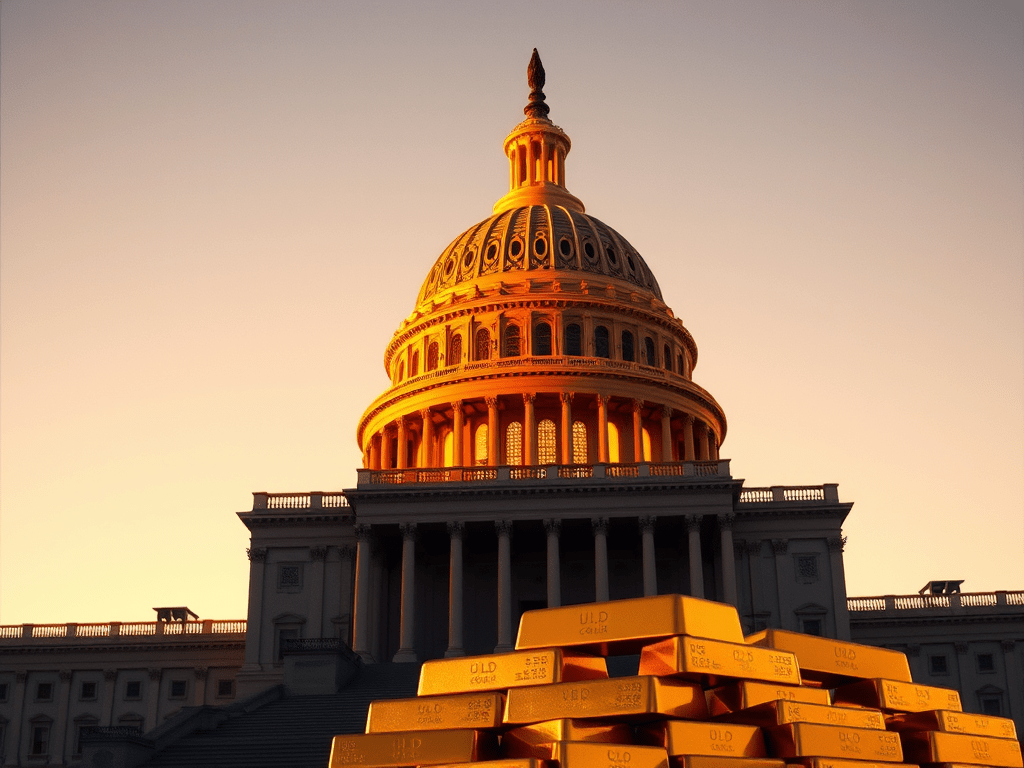

Why is the United States bringing its gold back home?

From the past few years, there is a trend that is getting more and more attention – countries all over the world are starting to repatriate their gold reserves and bring them back from foreign safes to their territory. Nations like Germany and Netherlands have been very vocal about their efforts and reasons for gold repatriation, which is very much unlike the strategy adopted by US whose actions have been more subtle in this respect. Let’s dive deep into the reasons for US to reclaim its gold reserves.

The Global Wave of Gold Repatriation

In the past, many nations kept a part of their gold within other nations’ boundaries, especially for security during wars or political instability. This was true for many nations as they housed their reserves overseas due to safety concerns. Nonetheless, this trend has been reverse for the last decade. Countries have started repatriating their assets with Germany’s Bundesbank bringing back 300 tons from the U.S. and 374 tons from France in the years of 2013 and 2016. In the same way, the Netherlands also brought back 122.5 tons of gold from the U.S. because the government said that they wanted gold on hand in case of a financial emergency.

The U.S. Perspective: Gold Derivatives and Physical Settlement

Source: Freepik

With the United States holding the highest number global with 8,133.5 tons, the gold reserves give an unchecked amount to assets. A large chunk of these reserves has been used in derivative contracts, such as options and futures contracts. Often, many of these contracts are settled in cash, where obligations stipulated within contracts are settled monetarily instead of the physical exchange of gold.

Nevertheless, these days settling via physical delivery is gaining popularity. This shift means that instead of cash, tangible gold is delivered in the party’s physical possession at the contract’s expiry date. This can be explained by various reasons, especially the growing global demand for real assets during economic uncertainty and worries over counterparty risks.

Geopolitical Tensions and Financial Sanctions

The geopolitical landscape is equally as important in these determinations. The U.S. and its allies’ freezing of around half of Russia’s $650 billion gold and forex reserves due to geopolitical phenomenon sent shockwaves worldwide. This action showed the risks countries face when their assets are held abroad. Hence, countries are opting to repatriate gold increasingly to mitigate the risks emanating from foreign sanctions.

Trust in the U.S. Financial System

In comparison to Western Europe, the U.S. politically and economically has always been regarded as a benign environment within which gold as an asset can be stored. Lately, these have not been so comforting for other countries. Invesco conducted a survey that found a significant share of central banks showed worry over how the U.S. manages its foreign reserves. This, in turn, made them reevaluate the locations where they store their gold.

The Future of Gold Storage

Due to the perpetual changes in global politics and economics, the relocation of gold is a trend that likely will not stop anytime soon. Nations are looking for better ways to store their wealth, leading to a shift in behavior towards gold storage. This requires the United States to modify its approaches in correspondence with shifting global trust and financial safety patterns.

Conclusion

The movement of gold reserves is more than just the transfer of an item from one location to another; it’s a reflection of the trust that the nations have, security issues, and complex financial strategies. At the moment, the United States seems to be changing its position regarding gold repatriation and physical currency settlements in light of greater global trends to ensure its reserves are both secure and accessible.

What’s your take on this emerging trend? Do you believe repatriating gold reserves is a prudent move for countries in today’s geopolitical climate?

Leave a comment