Source: XE.com

Warren Buffett’s Bold Bet on Japanese Trading Houses

Warren Buffett, also known as the Oracle from Omaha, is once again making waves but this time he is setting his sights on Japan. With many investors wading through tumultuous global markets, Buffett’s Berkshire Hathaway revealed that they have significantly increased their investments in Japan’s five major trading houses. But, this move is more than just a hasty decision. It demonstrates discipline and conviction in Japan’s future growth potential. But, what is the reason behind this sudden excitement? Let’s examine what motivated Buffett’s staggering investment.

A Macroeconomic Tailwind: The Yen’s Weakness and Policy Changes

Yen has been weakening over the last 5 years

Source: XE.com

The combination of factors that intrigued Buffett about Japan the most is the long term depreciation of the yen. This depreciation allows Japanese assets to be purchased for cheaper by foreign investors, providing them with an opportunity to purchase high quality companies at a lower price. Moreover, the recent moves implemented by the Bank of Japan, such as the gradual abandonment of their extremely accommodative monetary policy, hint towards a stronger yen in the coming years. For foreign investors possessing yen denominated assets, this could yield remarkable benefits. The BOJ has been under heavy scrutiny since they began trying to cap the yield curve and any alteration in this strategy will have an effect on the yen.

The Trading Houses: A Collection Of Value Investments.

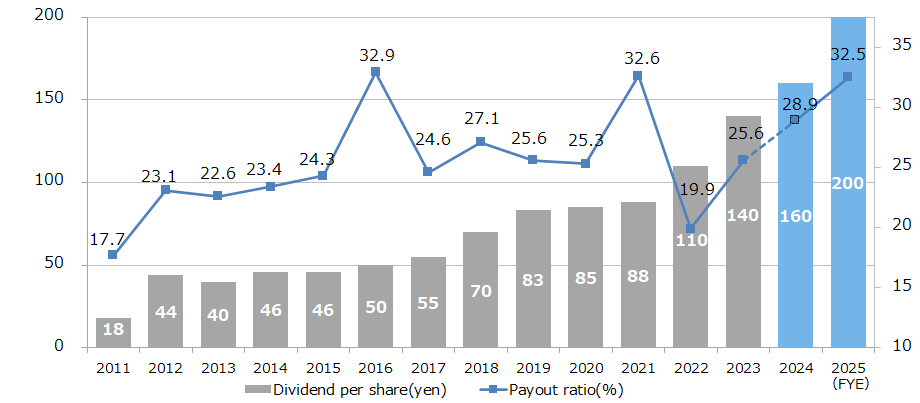

Dividend Per Share and Payout Ratio of Itochu Corp

Source: Itochu website

Buffett has not varied his focus from five major Japanese trading houses. These are Itochu Corp., Marubeni Corp, Mitsubishi Corp, Mitsui & Co, and Sumitomo Corp. As “sogo shosha,” these firms are information-certified and deal with a wide range of industries, including energy, metals, food, and machinery. Their mized activities provide a cushion against risks in a particular industry, which is a key feature of Buffet’s investments. These companies are known to have a record of high dividends over the years.

Practical Value Investing: Long-Term Prospects And Undervalued Investments

Warren Buffet’s investment focus has always been from the standpoint of determining the intrinsic value of a company and investing in those which have a positive growth potential. The Japanese trading houses, with their strong cash flows and diverse business activities, fit this vision perfectly. Furthermore, these companies are very active and supportive of shareholders via share buybacks and higher dividend payouts, which increases their attractiveness as value investments. By the way, these companies have also begun spending on renewable energy which is one of the most promising areas.

Looking Beyond The Numbers: A Cultural Context and A Strategic Partnership

Buffet has engagement with Japan goes deeper than just numbers on paper. He built strong networks among management at these trading houses which builds trust and understanding. This long term view, combined with an appreciation of the Japanese business culture, explains how deeply Buffett and his strategic thinking goes toward creating enduring business relationships. That long term view absolutely shapes his investment approach.

Final Thoughts: Japan, A Chance to Show Optimism

There is no other way to look at Buffet’s increased stake in Japanese trading houses other than a clear vote of confidence on the Japanese economy. It is a testament to the enduring appeal of value investing and the power of long term strategic partnerships. Buffett is proving yet again that he understands when to capitalize, and the current weakness of the yen certainly is an opportunity, as are all the other valuable assets which remain underestimated, and blindspots of uncertainty for many. Will other investors join the bandwagon? What do you think of Buffett’s latest strategic move? Japan seems to have a lot going for it, but what do you believe will happen in the vicinity of Japan’s economy?

Leave a comment