Navigating M&A: Key Trends for 2025 Success

The year 2024, in the realm of global mergers and acquisitions, felt like a strategic chess match. Companies, confronted with shifting economic winds and technological upheavals, were meticulously repositioning their pieces. The energy sector, a perennial M&A battleground, saw a heightened scramble as companies sought to balance the demands of traditional energy sources with the pressing need to transition towards renewables. This wasn’t merely about growth; it was about survival in an evolving market.

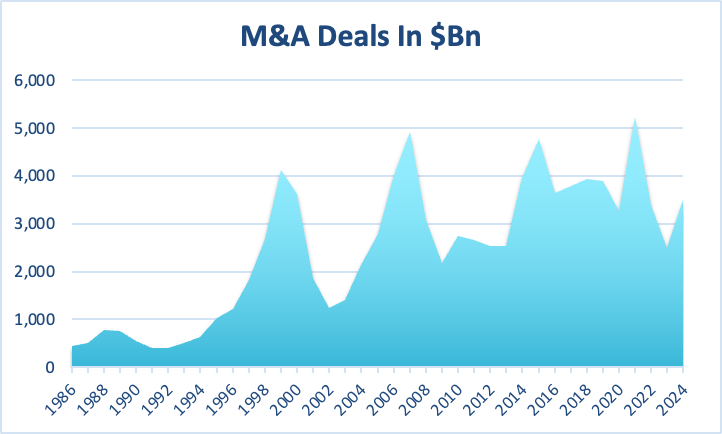

After facing headwinds over the past three years, the M&A landscape is poised for a resurgence in 2025, with renewed momentum and growth opportunities on the horizon.

Tech’s Ascendance: AI and Infrastructure Drive Deal Flow

Meanwhile, the relentless surge of artificial intelligence permeated every facet of the technology sector, igniting a frenzy of acquisitions. Companies, realizing that AI capabilities were no longer a luxury but a necessity, embarked on a race to secure talent and technology. This manifested in significant transactions, with a clear focus on cybersecurity and cloud infrastructure, as exemplified by the Synopsys/Ansys and HPE/Juniper deals. The telecom space, too, saw a flurry of activity, with investments in fiber infrastructure signaling a long-term bet on connectivity. In fact, technology transactions, representing 16% of all M&A activity, reclaimed its position as the leading sector, a testament to its dynamic nature.

Financial Realignment and Global Dynamics: PE’s Influence

Financial services, driven by the imperative of digital transformation, also witnessed significant consolidation. Geographically, North America remained the epicenter of dealmaking, but Europe displayed unexpected resilience, particularly in divestitures. Asia-Pacific, with its diverse economies, presented a more nuanced picture. And throughout it all, private equity firms, flush with capital, played a pivotal role, shaping the landscape of deal valuations and volume.

2025’s Emerging Deals: Energy, Telecom, and Infrastructure Lead

As we transition into 2025, the echoes of 2024’s strategic maneuvers reverberate. The acquisition of Marathon Oil by ConocoPhillips, a move that consolidates power in the Permian Basin, signals the energy sector’s continued drive for optimization. In Europe, Swisscom’s pursuit of Vodafone Italia promises to reshape the telecommunications landscape, though regulatory hurdles loom. And the investment in Allete by CPP Investments & GIP underscores the ongoing shift towards renewable energy infrastructure. The January 2025 announcement of Constellation Energy’s Acquisition of Calpine Corporation for 16.4 billion dollars, and Apollo and BC Partners’ 8 billion dollar investment into GFL Environmental, show that deal making has not slowed down.

Macroeconomic Catalysts: Interest Rates and Regulatory Shifts

The underlying forces driving this activity are multifaceted. The stabilization of interest rates, a crucial factor in deal financing, provides a sense of predictability that was absent in recent years. Moreover, the global economy’s resilience, defying earlier predictions of a sharp downturn, has instilled confidence in dealmakers. The easing of certain regulatory pressures in specific sectors further lubricates the wheels of M&A.

Technological Imperatives: AI and Digital Transformation as Drivers

Technological advancements, particularly the widespread adoption of AI, continue to be a primary catalyst. Companies are no longer just acquiring technology; they are acquiring the future. The need for digital transformation, a constant refrain across industries, compels companies to seek M&A opportunities as a means of accelerating their evolution.

Strategic Convergence: Why 2025 Is Poised for Robust Dealmaking

In essence, the 2025 M&A landscape is a reflection of strategic imperatives converging with favorable economic conditions. Companies, driven by the need to adapt and innovate, are leveraging M&A as a tool for growth and survival. The availability of capital, coupled with a more stable economic outlook, provides the necessary fuel.

Navigating the Future: Uncertainty and Opportunity in M&A

Looking ahead, while uncertainties remain, the stage is set for a robust year of dealmaking. Those who can navigate the complexities of the market, identify strategic opportunities, and execute deals effectively will thrive. The global economy is in a state of flux, and M&A will continue to be a vital instrument for companies seeking to chart a course through these shifting sands.

Leave a comment